Formula generator for PV function

The PV function calculates the present value of an annuity investment based on constant-amount periodic payments and a constant interest rate. It takes the following arguments: - rate: The interest rate per period. - number_of_periods: The total number of payment periods. - payment_amount: The amount of each payment. - future_value (optional): The future value remaining after the last payment has been made. If omitted, it is assumed to be 0. - end_or_beginning (optional): Specifies whether the payments are made at the end or beginning of each period. If omitted, it is assumed to be 0 (end of period).

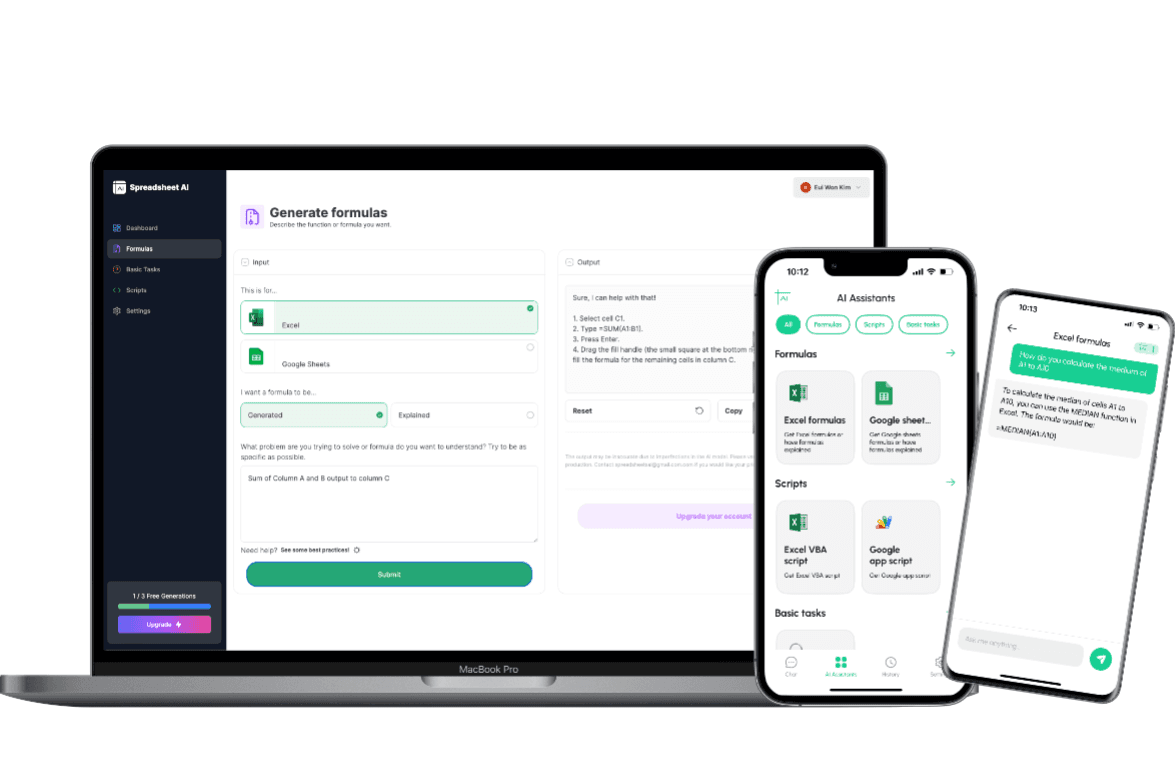

Formula generator

Spreadsheet AI is the #1 AI for generating and comprehending Excel and Google Sheets formulas. With its advanced capabilities, it goes beyond the basics by providing support for VBA and custom tasks. Streamline your spreadsheet with Spreadshee AI

How to generate an PV formula using AI.

To obtain information on the ARRAY_CONSTRAIN formula, you could ask the AI chatbot the following question: “To obtain the PV (Present Value) formula for a specific scenario, you can ask the AI chatbot the following question: "What is the formula for calculating the present value (PV) of an investment or cash flow with known future value, interest rate, and time period?"”

PV formula syntax

The PV function in Excel is used to calculate the present value of an investment or a loan. Its syntax is as follows: PV(rate, nper, pmt, [fv], [type]) - rate: The interest rate per period. - nper: The total number of payment periods. - pmt: The payment made in each period. - [fv]: Optional. The future value of the investment or loan. If omitted, it is assumed to be 0. - [type]: Optional. Specifies whether the payments are made at the beginning or end of each period. 0 or omitted for payments at the end of the period, 1 for payments at the beginning of the period. The PV function returns the present value of the investment or loan, which represents its current worth in today's dollars. It helps in evaluating the profitability or affordability of an investment or loan.

Use Cases & Examples

In these use cases, we use the PV function to calculate the present value of an investment or loan. The PV function helps determine the current worth of future cash flows, taking into account the interest rate and the time period.

Loan Payment Calculation

Description

Calculates the monthly payment amount for a loan based on the interest rate, number of periods, and loan amount.

Result

PMT(rate, number_of_periods, loan_amount)

Investment Growth Projection

Description

Estimates the future value of an investment based on the initial investment amount, interest rate, and number of periods.

Result

FV(rate, number_of_periods, initial_investment)

Retirement Savings Calculation

Description

Determines the amount of money needed to save each month in order to reach a desired retirement savings goal, based on the interest rate and number of years until retirement.

Result

PMT(rate, number_of_periods, -retirement_savings_goal)

AI tips

Enhance Your Excel Efficiency with AI Tips: Discover our innovative Excel add-in feature, ‘AI Tips.’ Streamline your workflow and boost productivity as AI-powered suggestions offer real-time insights for optimal spreadsheet organization, data analysis, and visualization. Elevate your Excel experience with intelligent recommendations tailored to your unique needs, helping you work smarter and achieve more.

Provide Clear Context

When describing your requirements to the AI, provide clear and concise context about the data you have, the specific task you want to accomplish, and any relevant constraints or conditions. This helps the AI understand the problem accurately.

Include Key Details

Include important details such as column names, data ranges, and specific criteria that need to be considered in the formula. The more precise and specific you are, the better the AI can generate an appropriate formula.

Use Examples

If possible, provide examples or sample data to illustrate the desired outcome. This can help the AI better understand the pattern or logic you are looking for in the formula.

Mention Desired Functionality

Clearly articulate the functionality you want the formula to achieve. Specify if you are looking for lookups, calculations, aggregations, or any other specific operations.

FAQ

Frequently Asked Questions

- The PV function in Excel is used to calculate the present value of an investment or a loan. It takes into account the future value, interest rate, and the number of periods.

- To use the PV function in Excel, you need to provide the required arguments: the interest rate, the number of periods, and the future value. You can also include additional arguments such as the payment amount or the type of payment.

- The syntax of the PV function in Excel is: PV(rate, nper, pmt, [fv], [type]). 'rate' represents the interest rate, 'nper' represents the number of periods, 'pmt' represents the payment amount, 'fv' represents the future value, and 'type' represents the type of payment (0 for end of period, 1 for beginning of period).

- Yes, the PV function in Excel can be used for both investments and loans. If the future value is positive, it represents an investment, and if it is negative, it represents a loan.

- Some common errors when using the PV function in Excel include providing incorrect arguments, such as using a negative interest rate or a wrong number of periods. It is important to double-check the inputs to ensure accurate results.