Formula generator for XNPV function

The XNPV function calculates the net present value of an investment by discounting a series of potentially irregularly spaced cash flows using a specified discount rate. It takes three arguments: the discount rate, an array of cash flow amounts, and an array of corresponding cash flow dates. The function considers the time value of money, giving more weight to cash flows that occur earlier in time. The result is the net present value of the investment.

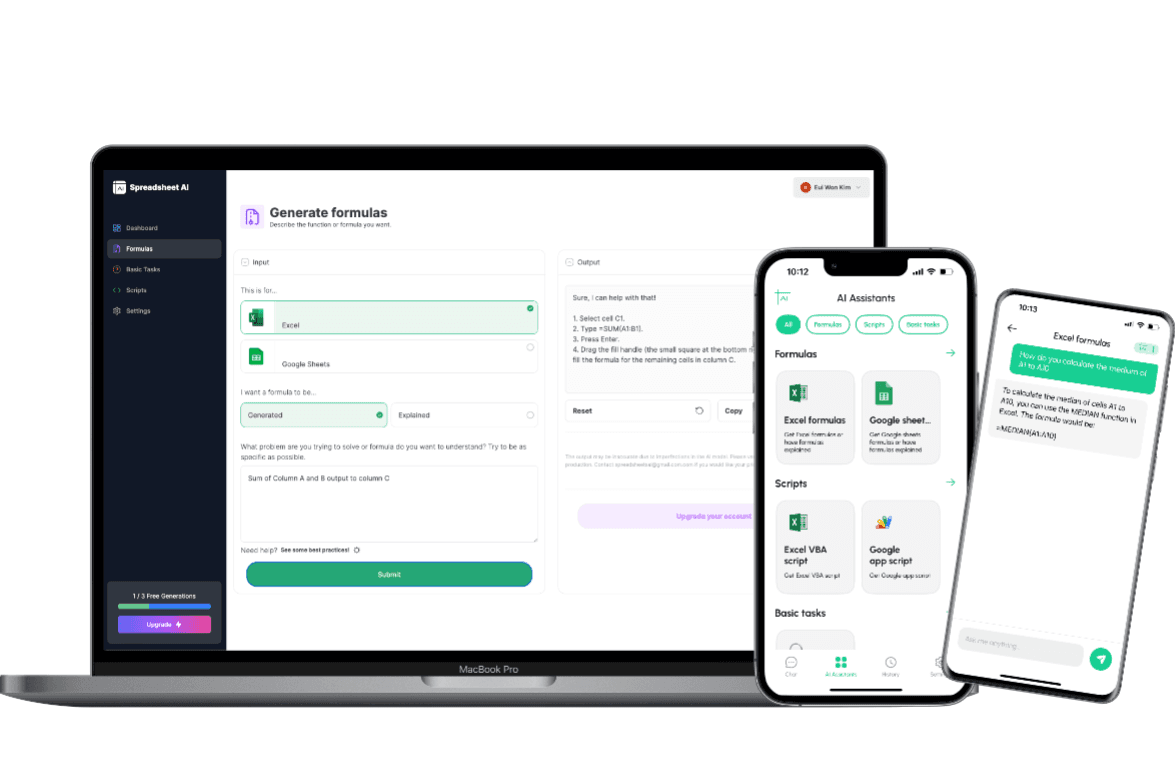

Formula generator

Spreadsheet AI is the #1 AI for generating and comprehending Excel and Google Sheets formulas. With its advanced capabilities, it goes beyond the basics by providing support for VBA and custom tasks. Streamline your spreadsheet with Spreadshee AI

How to generate an XNPV formula using AI.

To obtain information on the ARRAY_CONSTRAIN formula, you could ask the AI chatbot the following question: “To obtain the XNPV formula from an AI chatbot, you could ask the following question: "Can you provide me with the formula for calculating XNPV in Excel?"”

XNPV formula syntax

The XNPV function in Excel calculates the net present value of a series of cash flows that occur at irregular intervals. The syntax for the XNPV function is as follows: XNPV(rate, values, dates) - rate: The discount rate or interest rate per period. - values: An array or range of cash flows that correspond to the dates. - dates: An array or range of dates that correspond to the cash flows. The XNPV function returns the net present value of the cash flows, taking into account the timing of each cash flow and the specified discount rate. It is important to note that the dates must be sorted in chronological order for the function to work correctly.

Use Cases & Examples

In these use cases, we use the XNPV function to calculate the net present value of a series of cash flows, taking into account the specified discount rate and the dates of each cash flow.

Investment Analysis

Description

Calculates the net present value of an investment based on a specified series of potentially irregularly spaced cash flows and a discount rate.

Result

XNPV(discount, cashflow_amounts, cashflow_dates)

Loan Amortization

Description

Calculates the monthly payment amount for a loan based on the loan amount, interest rate, and loan term.

Result

PMT(interest_rate, loan_term, loan_amount)

Sales Forecasting

Description

Calculates the projected sales for a product based on historical sales data and a growth rate.

Result

FORECAST(growth_rate, historical_sales, future_period)

AI tips

Enhance Your Excel Efficiency with AI Tips: Discover our innovative Excel add-in feature, ‘AI Tips.’ Streamline your workflow and boost productivity as AI-powered suggestions offer real-time insights for optimal spreadsheet organization, data analysis, and visualization. Elevate your Excel experience with intelligent recommendations tailored to your unique needs, helping you work smarter and achieve more.

Provide Clear Context

When describing your requirements to the AI, provide clear and concise context about the data you have, the specific task you want to accomplish, and any relevant constraints or conditions. This helps the AI understand the problem accurately.

Include Key Details

Include important details such as column names, data ranges, and specific criteria that need to be considered in the formula. The more precise and specific you are, the better the AI can generate an appropriate formula.

Use Examples

If possible, provide examples or sample data to illustrate the desired outcome. This can help the AI better understand the pattern or logic you are looking for in the formula.

Mention Desired Functionality

Clearly articulate the functionality you want the formula to achieve. Specify if you are looking for lookups, calculations, aggregations, or any other specific operations.

FAQ

Frequently Asked Questions

- The XNPV function calculates the net present value of a series of cash flows that occur at irregular intervals.

- To use the XNPV function, you need to provide the discount rate, the series of cash flows, and the dates associated with each cash flow.

- The syntax of the XNPV function is: XNPV(discount_rate, values, dates)

- Yes, the XNPV function can handle cash flows at irregular intervals, as long as you provide the correct dates for each cash flow.

- The XNPV function returns the net present value of the cash flows, which represents the total value of the cash flows at the given discount rate.